How Feie Calculator can Save You Time, Stress, and Money.

Feie Calculator Fundamentals Explained

Table of ContentsGetting The Feie Calculator To Work8 Easy Facts About Feie Calculator DescribedFeie Calculator Can Be Fun For EveryoneEverything about Feie CalculatorUnknown Facts About Feie Calculator

He sold his United state home to establish his intent to live abroad permanently and applied for a Mexican residency visa with his wife to assist fulfill the Bona Fide Residency Examination. Furthermore, Neil secured a long-lasting property lease in Mexico, with plans to at some point buy a residential or commercial property. "I presently have a six-month lease on a house in Mexico that I can prolong an additional six months, with the purpose to buy a home down there." However, Neil mentions that acquiring building abroad can be challenging without initial experiencing the place."It's something that people need to be really thorough concerning," he states, and encourages deportees to be careful of typical errors, such as overstaying in the U.S.

Neil is careful to stress to Anxiety tax united state that "I'm not conducting any performing any kind of Organization. The U.S. is one of the couple of countries that taxes its residents regardless of where they live, indicating that also if an expat has no income from U.S.

tax returnTax obligation "The Foreign Tax Credit history permits individuals working in high-tax nations like the UK to offset their United state tax obligation liability by the quantity they've currently paid in taxes abroad," states Lewis.

4 Simple Techniques For Feie Calculator

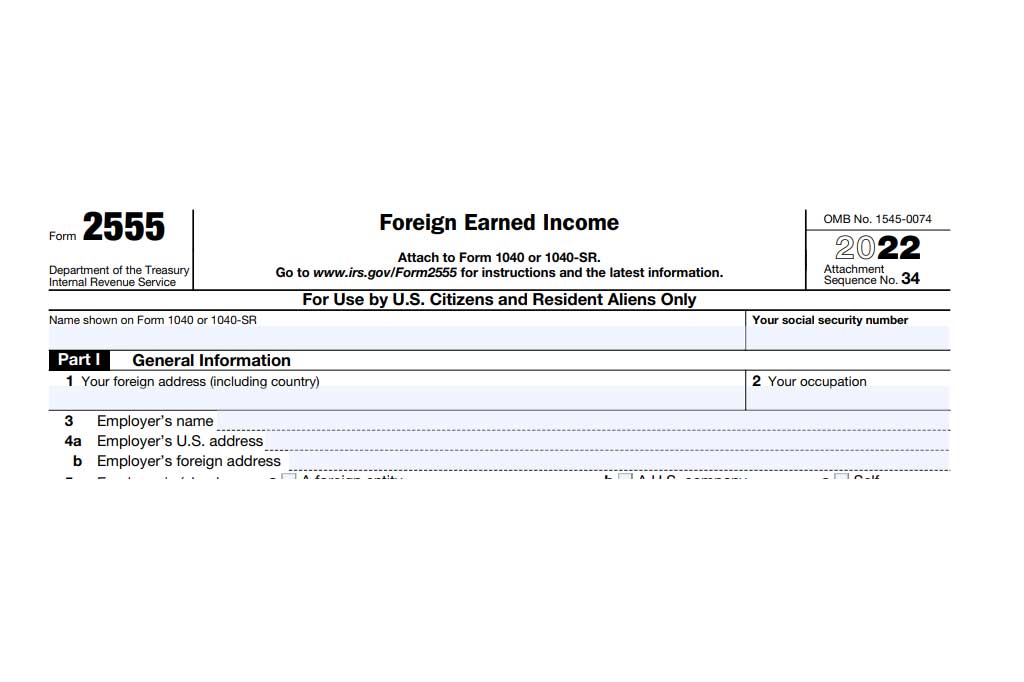

Below are some of one of the most regularly asked inquiries concerning the FEIE and other exclusions The Foreign Earned Earnings Exclusion (FEIE) allows U.S. taxpayers to leave out approximately $130,000 of foreign-earned revenue from government income tax, decreasing their U.S. tax responsibility. To get approved for FEIE, you should meet either the Physical Presence Test (330 days abroad) or the Bona Fide Residence Examination (prove your key house in an international country for a whole tax year).

The Physical Existence Test requires you to be outside the U.S. for 330 days within a 12-month period. The Physical Visibility Test likewise needs U.S. taxpayers to have both an international income and an international tax home. A tax obligation home is specified as your prime location for service or work, regardless of your family's residence.

The smart Trick of Feie Calculator That Nobody is Discussing

An income tax treaty in between the united state and another country can aid avoid dual taxes. While the Foreign Earned Income Exclusion decreases gross income, a treaty might offer extra advantages for qualified taxpayers abroad. FBAR (Foreign Checking Account Report) is a needed declare united state people with over $10,000 in foreign financial accounts.

Eligibility for FEIE depends upon conference certain residency or physical visibility tests. is a tax obligation expert on the Harness platform and the owner of Chessis Tax. He is a participant of the National Organization of Enrolled Representatives, the Texas Culture of Enrolled Agents, and the Texas Society of CPAs. He brings over a decade of experience benefiting Large 4 companies, recommending expatriates and high-net-worth individuals.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax expert on the Harness platform and the creator of The Tax obligation Dude. He has over thirty years of experience and now concentrates on CFO solutions, equity payment, copyright taxes, cannabis taxes and divorce relevant tax/financial preparation matters. He is a deportee based in Mexico - https://sketchfab.com/feiecalcu.

The foreign earned income exclusions, in some cases described as the Sec. 911 exclusions, leave out tax on earnings made from working abroad. The exclusions make up 2 parts - a revenue exclusion and a housing exemption. The following FAQs review the advantage of the exclusions consisting of when both partners are deportees in a basic fashion.

Fascination About Feie Calculator

The tax obligation benefit omits the earnings from tax obligation at bottom tax obligation prices. Formerly, the exclusions "came off the top" minimizing income subject to tax obligation at the leading tax obligation rates.

These exemptions do not excuse the incomes from United States tax but simply offer a tax reduction. Keep in mind that a solitary person functioning abroad for every one of 2025 who earned regarding $145,000 without any various other income will have gross income reduced to zero - properly the exact same answer as being "free of tax." The exemptions are calculated every day.